In May 2025, India’s insurance sector witnessed

transformative changes, led by the landmark policy

allowing 100% foreign direct investment (FDI) under the

automatic route, as announced in the Union Budget

2025–26. This move aims to attract global capital, boost

competition, and foster innovation, with the condition

that all premium collections remain invested within India.

The Finance Minister also signalled further liberalization

by promising to review and simplify foreign investment

regulations. Simultaneously, the Insurance Regulatory

and Development Authority of India (IRDAI) initiated a

legal overhaul, forming a seven-member committee

propose amendments to the Insurance Act, 1938.

Proposed reforms such as risk-based solvency norms

and changes to surrender policies are intended to

modernize the sector and enhance capital efficiency.

Industry performance remained robust, with non-life

insurance premiums growing 13.5% year-on-year in April

2025, totalling ₹33,688.5 crore. The sector also crossed

the ₹3 lakh crore premium mark for FY25, with

projections indicating 7.1% annual growth through

2028—making it the fastest-growing insurance market

among G20 nations. The FDI limit hike triggered

immediate positive stock market reactions, with major

insurers like SBI Life and HDFC Life gaining over 3%,

reflecting investor confidence. The policy change also

paves the way for increased mergers, restructuring of

joint ventures, and entry of new foreign players, reshaping

the competitive landscape. The planned composite

license regime, allowing insurers to operate across life,

health, and general segments, is expected to further

intensify competition. Additionally, the push toward

digital transformation continues through initiatives like

Bima Sugam, Bima Vistaar, and Bima Vahaks, aimed at

improving access and innovation, especially in

underserved areas. Regulatory safeguards remain in

place to ensure sectoral stability, including domestic

investment mandates and governance norms. Overall,

May 2025 marked a turning point for Indian insurance,

setting the stage for rapid expansion, enhanced investor

participation, and improved consumer outcomes.

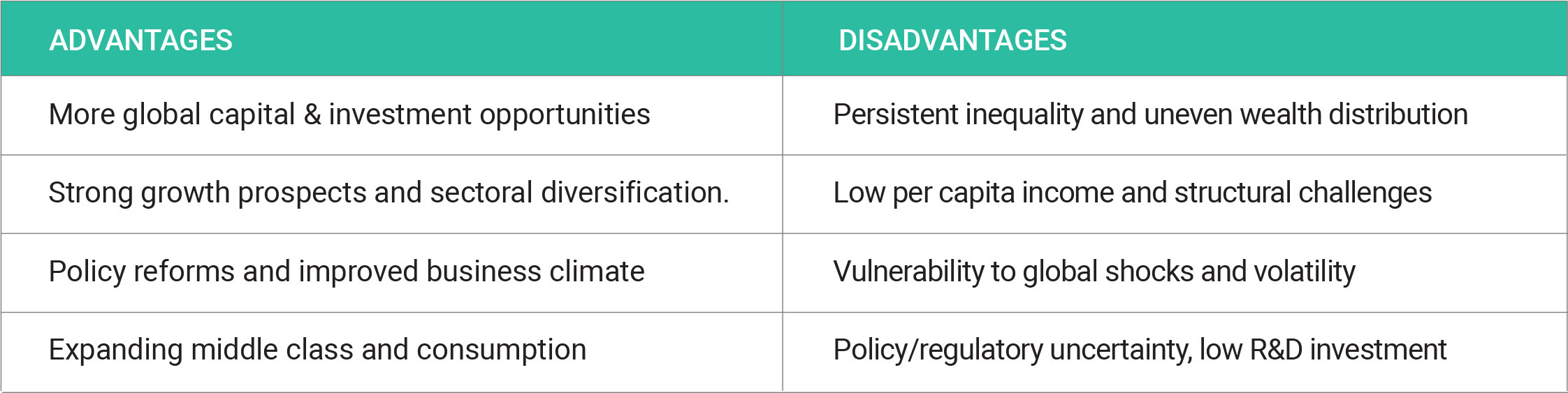

INDIA BECOMES THE 4TH LARGEST ECONO MY - ADVANTAGES AND DISADVANTAGES

India’s rise to the 4th largest economy brings Indian

investors more global opportunities, sectoral growth, and

policy support, but also exposes them to persistent

inequality, structural challenges, and greater vulnerability

to global shocks. The benefits for investors will depend

on how inclusively and sustainably this growth is

managed.