April 2025 presented a mixed yet insightful picture for

India’s mutual fund landscape, marked by impressive

equity fund performances, heavy outflows in debt

categories, and heightened volatility across several

segments. While investors benefited from selective

rallies, macroeconomic and geopolitical developments

introduced a degree of unpredictability.

Leading the performance charts were mid-cap equity

funds, which outpaced both large- and small-cap peers.

Despite strong returns, mid-cap and small-cap equity

funds were among the most volatile, swinging sharply in

response to foreign portfolio movements, elevated

valuations, and geopolitical concerns.

On the debt side, gilt funds emerged as surprise

outperformers, riding the tailwinds of falling bond yields.

With India’s 10-year government bond yield dropping to a

three-year low, top gilt funds offered over 5% returns for

the month. Corporate bond funds also registered decent

gains of around 3–4%, particularly those exposed to

high-quality issuers.

Credit risk funds and other rate-sensitive debt categories

also faced instability, largely influenced by changing

interest rate expectations and RBI’s April rate cut.

Meanwhile, sectoral and thematic funds, especially

those tied to export-led industries or tech, saw

inconsistent flows and returns amid a backdrop of trade

policy changes.

Multiple macro and policy factors contributed to April's

volatility. The month saw foreign investor outflows,

particularly in the first half, as global trade tensions and

protectionist policies from the U.S. spurred risk-off

sentiment. Sluggish GDP growth and muted earnings

from certain sectors added to investor caution.

Elevated market valuations prompted profit booking,

especially in mid- and small-cap segments, while

underperformance in specific sectors also weighed on

thematic funds. In terms of investor behaviour, equity

funds maintained healthy net inflows, with mid-cap,

small-cap, and flexi-cap categories drawing the most

interest. While large-cap funds saw flat flows,

sectoral/thematic funds experienced a dip in net inflows

as investors grew more cautious.

Conversely, debt funds witnessed significant outflows,

especially from gilt, floating rate, and constant maturity

schemes. These withdrawals were partly seasonal,

driven by advance tax payments, and partly due to

shifting interest rate differentials as U.S. bond yields

rose. Interest rate fluctuations and persistent inflationary

concerns further impacted debt fund valuations. Rising

geopolitical tensions—including the India-Pakistan

border flare-up—led to a flight to safety, spurring erratic

fund flows and market corrections.

Hybrid funds had a mixed month. Multi-asset and

balanced advantage funds saw steady inflows, while

conservative hybrid schemes—heavy on debt

allocations—suffered outflows. Meanwhile, passive

funds, particularly index ETFs, continued to gain traction

among retail investors, signalling a growing preference

for low-cost, market-linked strategies.

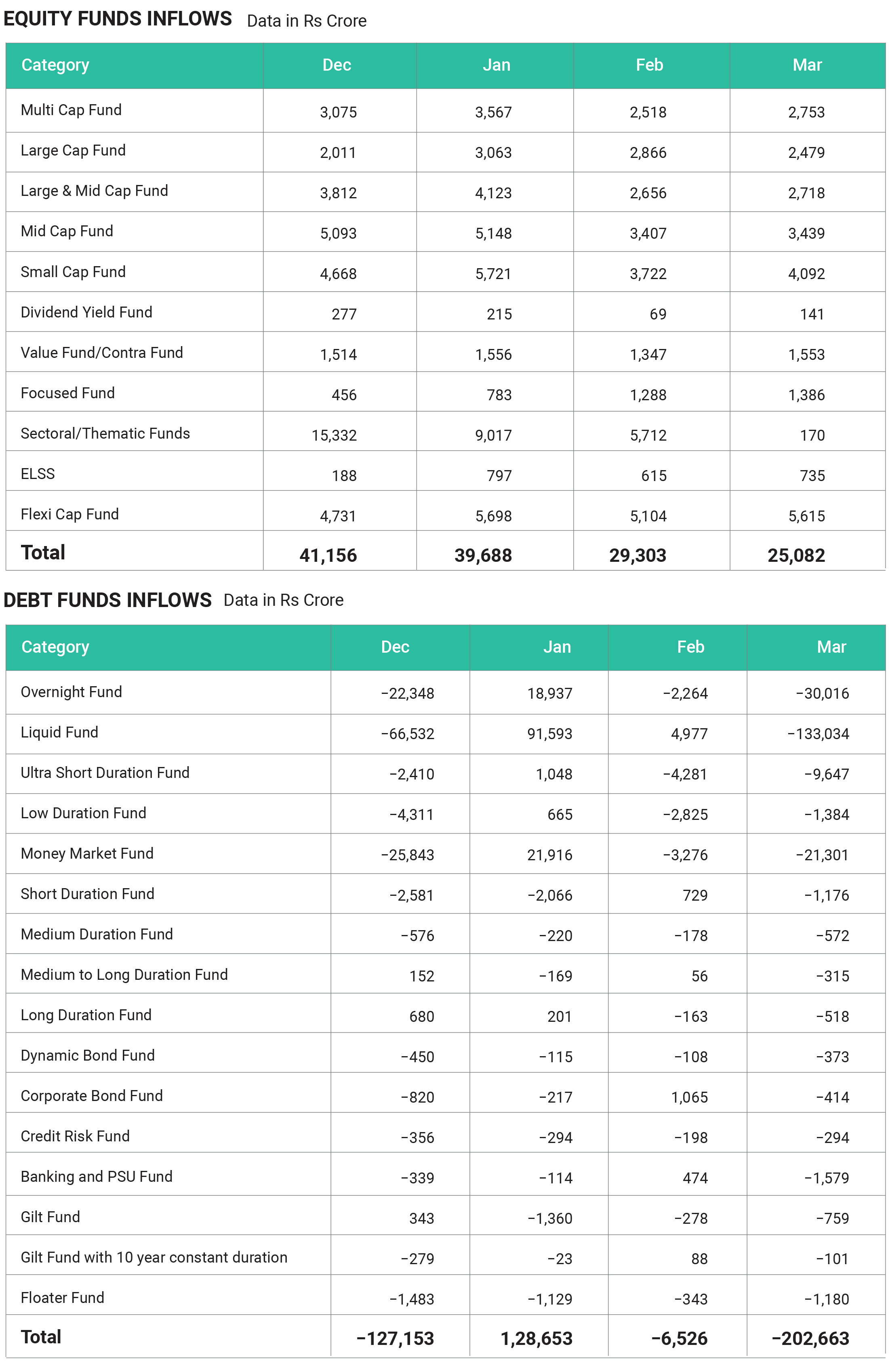

KEY TAKEAWAYS FROM AMFI INDIA DATA – MARCH 2025

Record Industry AUM: Mutual fund industry assets under management (AUM) reached ₹65.74 lakh crore, up 1.87%

month-on-month and 23% year-on-year, marking a more than sixfold increase over the past decade.

Equity Fund Trends: Equity mutual fund inflows dropped 14% to an 11-month low of ₹25,082 crore, reflecting investor caution

amid market volatility and global uncertainty, though equity AUM rose to ₹29.5 lakh crore due to market gains and SIPs.

Debt Fund Outflows: Debt-oriented schemes saw significant outflows (over ₹1.6 lakh crore), mainly from liquid funds, as

corporates withdrew for quarter-end advance tax payments.

Hybrid and Passive Funds: Hybrid fund AUM grew, led by strong inflows into multi-asset allocation funds. Passive funds hit

a record ₹11.47 lakh crore AUM, with net inflows for the 53rd consecutive month.

SIP Growth: SIP collections were robust at ₹25,926 crore, up 34.5% year-on-year, though they declined for the fourth straight

month, reflecting cautious sentiment.

Investor Base: Total mutual fund folios reached 23.45 crore, with retail investors (equity, hybrid, solution-oriented schemes)

accounting for about 18.58 crore folios

To conclude, April 2025 showcased a dynamic mutual fund environment, where mid-cap and gilt funds stood out as top performers amidst a backdrop of volatility, foreign capital shifts, and shifting investor strategies. The month reaffirmed the importance of diversification, timing, and risk management in navigating India’s evolving investment landscape