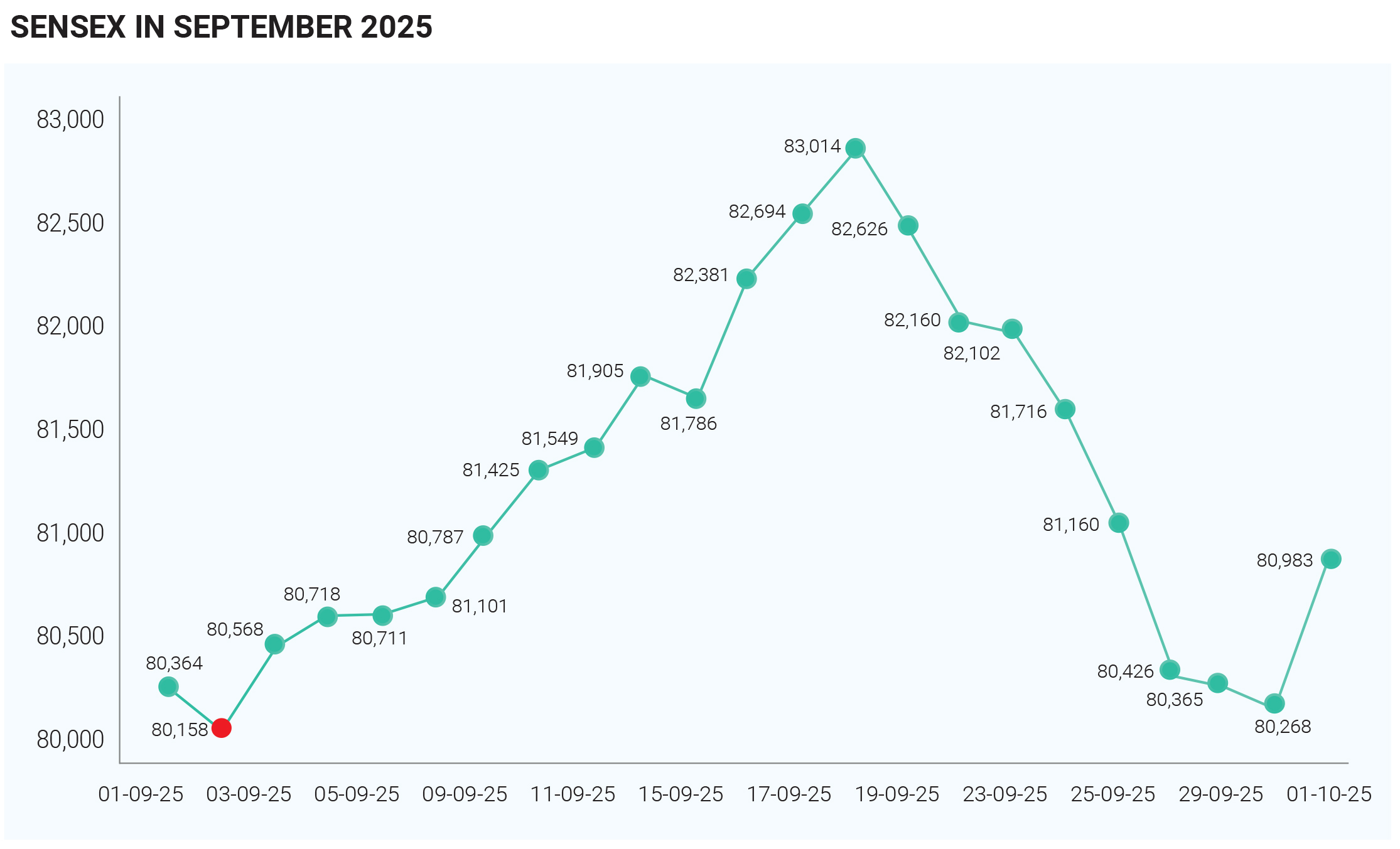

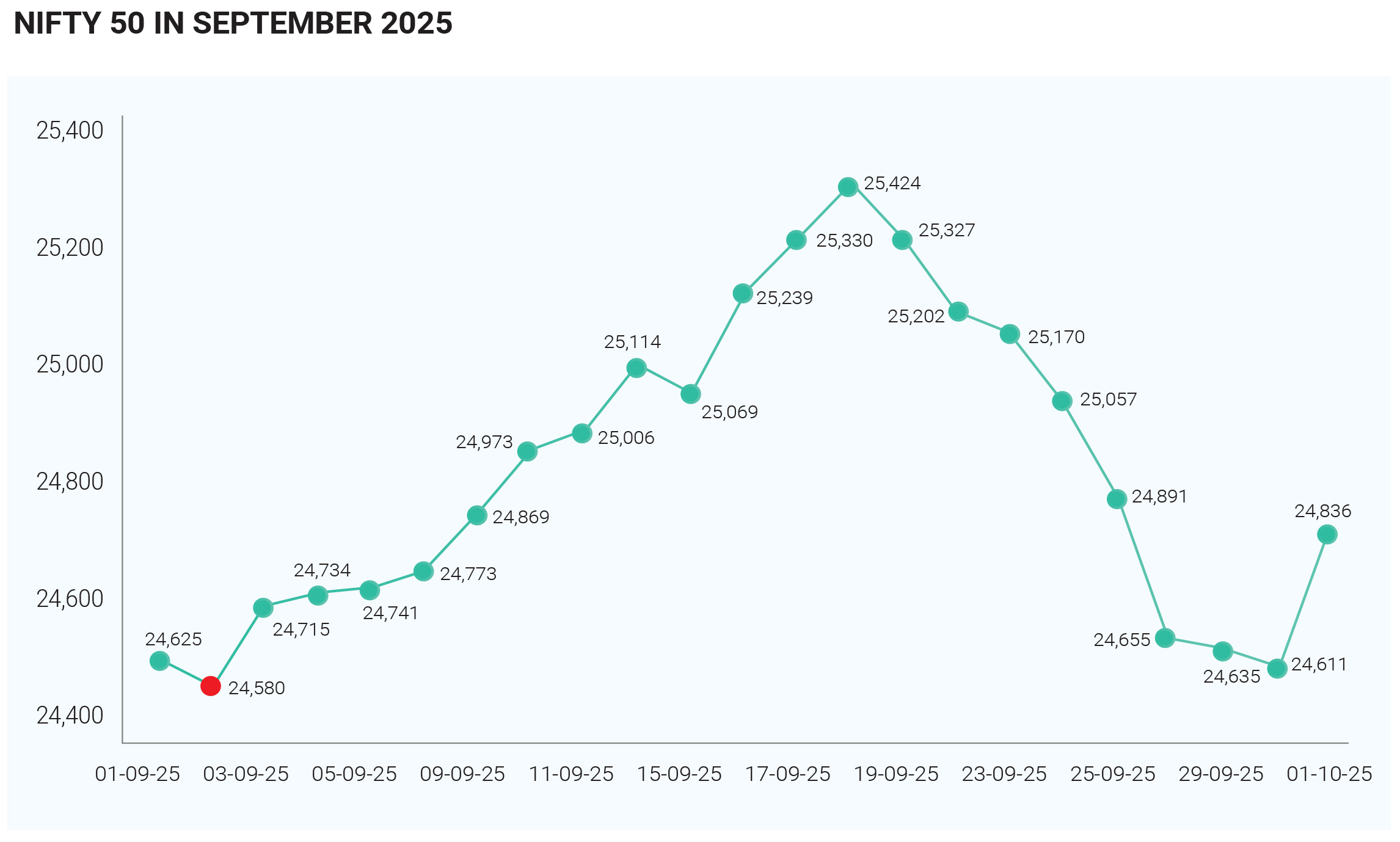

In September 2025, the Indian equity markets, represented by benchmark indices Sensex and Nifty, experienced a largely sideways and muted performance, marked by heightened volatility, intermittent rallies, and persistent selling pressure. Despite early optimism in the month, both indices ended with flat to modest gains, largely shaped by a complex mix of domestic developments, global headwinds, sector-specific drags, and significant foreign institutional investor (FII) outflows. The overall tone of the market throughout the month was cautious and reactive, with participants navigating an environment filled with economic uncertainty, global policy shifts, and mixed corporate signals.

At the beginning of September, investor sentiment appeared upbeat. Both Sensex and Nifty climbed toward near-record highs, with the Sensex hovering between 80,300 and 81,900, while the Nifty traded between 24,700 and slightly above 25,100. This early rally was largely underpinned by optimism surrounding positive macroeconomic data, upbeat earnings expectations, and hopes of pro-growth policy reforms. However, this upward momentum failed to sustain itself as the month progressed, with the market losing steam in the latter half. Sectoral underperformance—particularly in IT, auto, and consumer-facing segments—combined with global uncertainty, led to a loss of gains and a shift in investor tone from bullish to defensive. By month-end, the Sensex and Nifty had posted monthly returns in the narrow range of 0.6% to 1.5%, highlighting the lack of decisive directional movement. Several factors contributed to this subdued performance. On the global front, ongoing trade tensions between the United States and India weighed heavily on sentiment. The imposition of 50% tariffs by the US on key Indian exports, including automobiles, textiles, and pharmaceuticals, sparked concerns over India’s export competitiveness and pressured related sectors. Simultaneously, continued uncertainty surrounding H-1B visa reforms in the US negatively impacted India’s IT sector—a long-time favourite among FIIs and a significant contributor to India’s services exports. The IT index fell sharply, registering a year-to-date decline of over 18% by the end of September, exacerbating selling pressure across the broader market. In addition, concerns about global economic health further fuelled caution. Investors were increasingly wary of a slowdown in the US and EU economies, sticky inflation, and the possibility of delayed interest rate cuts by the US Federal Reserve. These fears led to risk aversion among global investors, prompting them to exit emerging markets, including India. The Indian rupee also faced depreciation pressure, further eroding the appeal of Indian assets to foreign investors. As a result, FIIs were substantial net sellers in September, withdrawing between $2.5 billion and $2.7 billion (approximately ₹22,000 crore) from Indian equities, marking the third consecutive month of significant outflows. Domestically, the market narrative was shaped by a mix of positive structural reforms and ongoing macroeconomic concerns. One of the most significant developments was the announcement of GST rate cuts in late September. The government undertook long-awaited tax slab simplification, aimed at boosting consumption and improving ease of doing business. While the reform was welcomed from a long-term perspective, its short-term market impact was mixed. Uncertainty around the pace at which businesses would pass on these benefits to consumers limited the immediate positive reaction. Nonetheless, record GST collections for the month, touching ₹1.89 lakh crore, served as a testament to resilient domestic demand and strong compliance, offering some support to the markets amidst growing external pressures. On the economic front, the Asian Development Bank (ADB) revised India’s growth outlook upward to 6.5% for FY26–FY27, citing strong domestic fundamentals. This revision, coupled with robust manufacturing PMI data and steady credit growth in the banking sector, painted a relatively healthy picture of the domestic economy. Yet, this optimism was tempered by downward revisions in corporate earnings forecasts. Key sectors such as consumer durables, pharmaceuticals, and especially IT failed to meet analysts’ expectations, triggering profit booking and further dampening market sentiment. Defensive sectors like FMCG and PSU banks, which initially acted as safe havens, also saw selling pressure due to profit-taking and valuation concerns. The PSU banks and metals displayed relative resilience, supported by strong balance sheets, government capex, and continued demand from infrastructure and export markets. On the other hand, IT stocks bore the brunt of global policy and demand concerns. Consumer-facing sectors remained under pressure, weighed down by tepid festival-season demand and cautious investor positioning. Pharma stocks also struggled amid regulatory uncertainty in the US and weak margin guidance. However, midcaps and smallcaps saw selective investor interest, especially in financials, infrastructure-related plays, and new-age tech companies with domestic focus. Volatility throughout the month was driven not only by economic data but also by political and social developments. Early in the month, devastating floods in Punjab resulted in fatalities and widespread crop damage, contributing to concerns over food inflation and rural demand. Around the same time, reports of GST refund fraud and large-scale enforcement actions by tax authorities introduced an element of regulatory risk. Mid-September brought another inflationary data point, with retail inflation edging up slightly to 2.07% in August, raising fresh concerns about consumer purchasing power and demand recovery. The underlying theme for the Indian markets during September 2025 was the tug-of-war between structural domestic strength and persistent global fragility. On the one hand, India continued to benefit from strong tax collections, improving economic forecasts, and a supportive policy environment. On the other hand, markets were haunted by deteriorating global relations—particularly the US-India trade standoff—high FII withdrawals, and sectoral earnings disappointments. These opposing forces led to choppy trading patterns, with no clear breakout or breakdown across the major indices. To summarise September 2025 was a month of equilibrium for the Indian stock market—where the forces of growth optimism and policy reform clashed with the realities of global headwinds, earnings stress, and foreign investor retreat. Despite strong macroeconomic indicators like record GST collections and an improved GDP outlook, the market was unable to capitalize on these positives due to the drag from IT, consumption, and external volatility. FII outflows, amounting to nearly ₹22,000 crore in a single month, served as a critical headwind and one of the primary reasons for the lacklustre performance of Sensex and Nifty. Policy developments like GST rate cuts showed the government's intent to revive demand, but investors remained cautious about the short-term implications.